31+ Mortgage principal and interest

According to the Consumer Financial Protection Bureau CFPB Principal is the money that you originally agreed to pay back. Your payment calculation will need to include the principal and.

Img003 Jpg

So this is the first parameter pv for the functionsIt must be entered as a negative value.

. PL c 1cn 1cn-1 P the payment. As you pay this amount back the amount you still have to repay is also known as the principal. Therefore the initial interest rates are normally 05 to 2 lower than FRM with the same loan term.

Now is the Time to Take Action and Lock your Rate. Excel Mortgage Formula to Fixed Periodic Payment. The amount you owe without any interest added.

As you pay this amount back the amount you still have to repay is also known as the principal. This calculator will help you to compare the monthly payment amounts for an interest-only mortgage and a principal-interest mortgage. Ad Get mortgage rates in minutes.

If you are in a variable-rate mortgage chances are that with recent and future rate increases your mortgage may reach a trigger point. Ad A Ton Of Course Options For Completing Your TX Mortgage Pre-Licensing Classes. Lock Your Rate Now With Quicken Loans.

Voila theres your monthly principal. The amount you owe without any interest added. These four parts are principal interest taxes and insurance.

C the period interest rate which consits of dividing the APR as a decimal by the frequency of payments. 9 hours ago30-year mortgage refinance rate advances 005. If you buy a home for 400000 with 20 down.

Mortgage Self Study Course. Divide your interest rate by the number of payments youâll make in the year. You can apply extra payments directly to the principal balance of your mortgageMaking additional principal paymentsreduces the amount of money youll pay.

Since your monthly payment stays the same each month the lender puts more of your payment toward principal because you dont owe as much interest. Like the principal component a portion of each mortgage payment you make covers the interest. So for example if youâre making monthly payments divide by 12.

Contract In Pdf 31 Examples. To calculate mortgage interest paid for the second month you first need to recalculate your mortgage balance. To illustrate lets assume that the.

Principal and interest defined. The principal refers to the loan amount when you take out a loan. Affordable NMLS Approved Licensing With The CE Shop.

Loan Amount- - Given loan amount. Now if youll recall interest payments are based on the. Multiply it by the balance.

On a 750000 jumbo mortgage the. The front-end debt to income ratio is also is known as the housing ratio. Simply take your total loan amount divide it by the loan term and then divide that number by 12.

The loan term refers to the number of years you have to pay back the mortgage lender the money you have borrowed. Likewise the previous methods dataset loan amount 150000 is in cell C7 rate of interest is in cell C8 which is 6. In this way youll be.

When you make an extra payment your mortgage company should give you the option of applying it to your loans principal interest escrow or the following months. 415 42 votes. Now is the Time to Take Action and Lock your Rate.

Lock Your Rate Now With Quicken Loans. Yearly Rate- 10- 10 interest rate. Ad Were Americas 1 Online Lender.

Mortgage interest rates are normally expressed in Annual Percentage Rate APR. Compare up to 5 free offers now. Since you paid 1250 towards your principal in the first.

Make lenders compete and choose your preferred rate. For example if you take out. The average 30-year fixed-refinance rate is 610 percent up 5 basis points from a week ago.

Also included are optional fields for taxes. If the interest portion of the January 1 loan payment is for the month of December then the interest portion should be accrued as of December 31. Your monthly payments will be around 2240 and after a year you would have made.

Ad Lock In Lower Monthly Payments When You Refinance Your Home Mortgage. A month ago the average. Ad Were Americas 1 Online Lender.

Compare offers from our partners side by side and find the perfect lender for you. A 30-year jumbo mortgage at todays fixed interest rate of 600 will cost you 600 per month in principal and interest per 100000. The Bottom Line.

The housing ratio consists of the principal interest taxes and insurance which is also referred to. L the loan value.

2

Azulejos Para Banos Pequenos Diseno De Banos Chicos Diseno De Banos

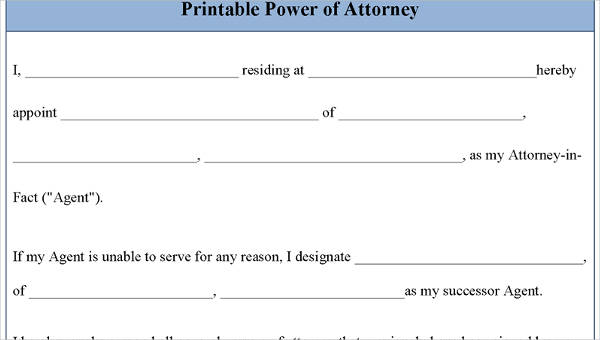

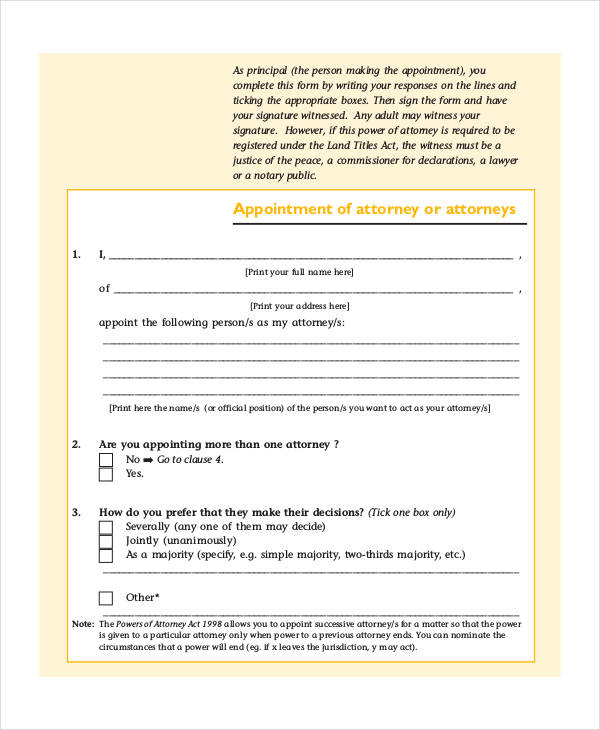

Free 31 Sample Power Of Attorney Forms In Pdf Ms Word

31 Appointment Letter Templates Pdf Google Doc Apple Pages Job Application Letter Template Lettering Letter Templates

Pin On Savings Side Gigs Financial Success

Prosper 424b3 20160630 Htm

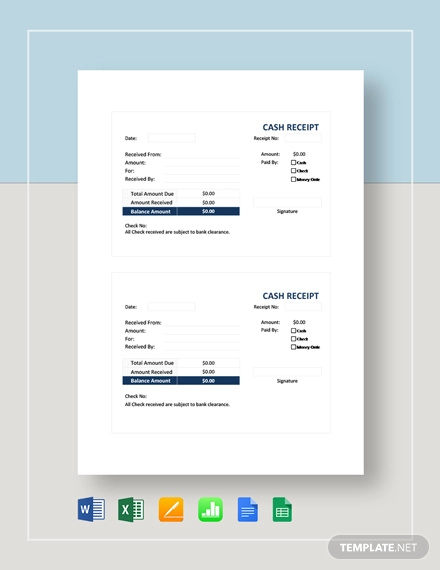

31 Money Receipt Templates Doc Pdf Free Premium Templates

![]()

Should You Skip Mortgage Payments If You Don T Have To

G201504061231515332622 Jpg

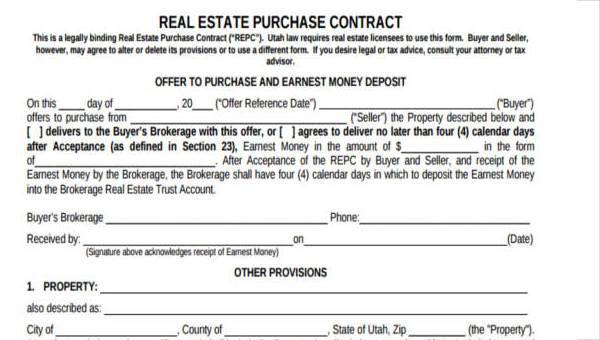

Free 31 Contract Agreement Sample Forms In Pdf Ms Word

Pin On Bible Study

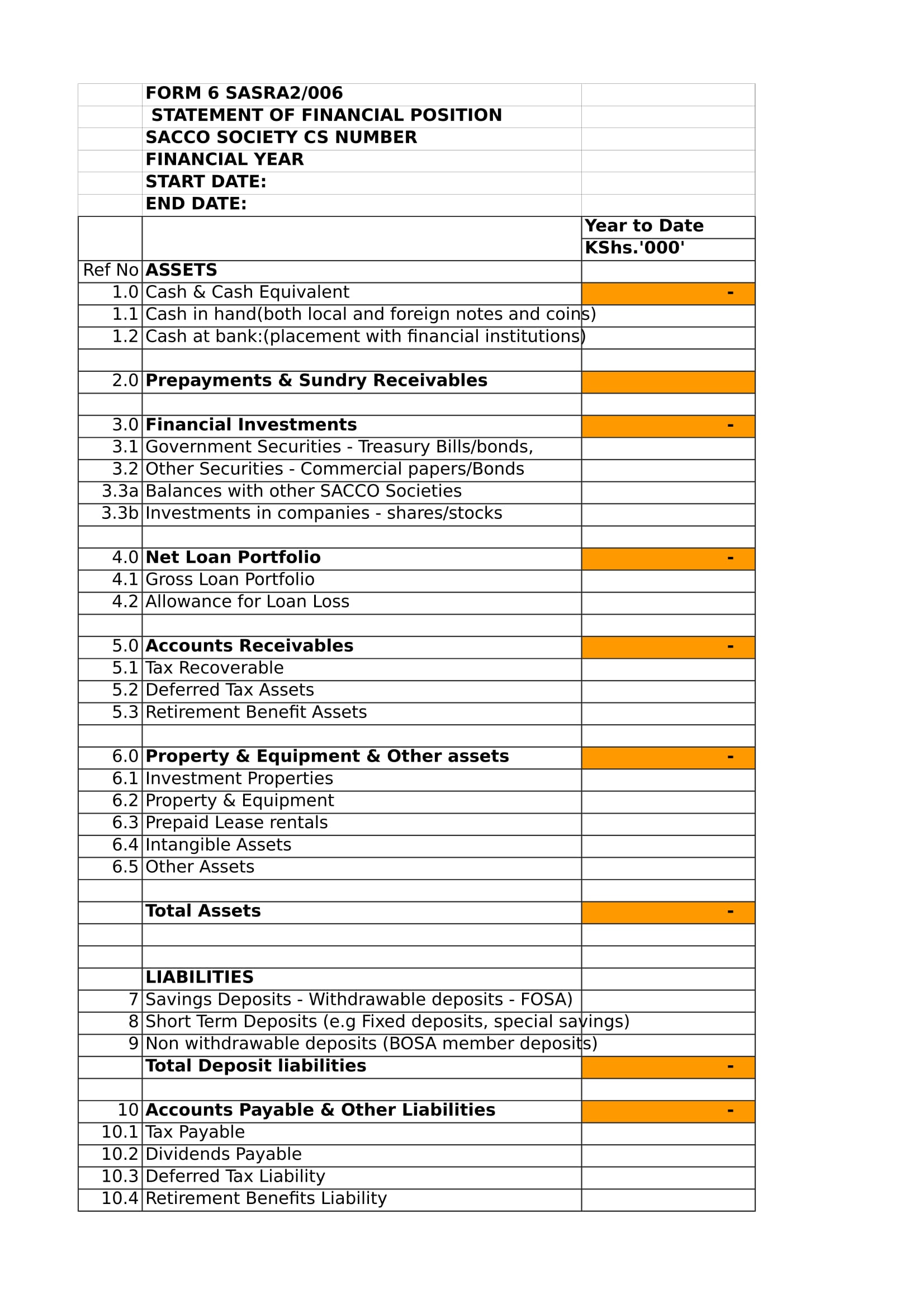

Free 31 Statement Forms In Excel Pdf Ms Word

Family Loan Agreement 10 Examples Format Pdf Examples

Contract In Pdf 31 Examples Format Sample Examples

Contract In Pdf 31 Examples Format Sample Examples

Free 31 Sample Power Of Attorney Forms In Pdf Ms Word

Free Note Examples 31 In Pdf Doc Examples